Investing might feel more info daunting, especially when you're just just dipping your toes. But it doesn't a complex endeavor! Robo-advisors offer a easy solution for optimizing your portfolio. These automated platforms employ algorithms with create customized investment portfolio based on your comfort level.

With a robo-advisors, you can begin investing with little to no effort. Simply provide your financial information, and the platform will handle the rest. Robo-advisors always observe market conditions and adjust your portfolio as needed, ensuring that your investments are properly positioned with your aspirations.

- Consider robo-advisors if you're looking for a affordable way to invest.

- These platforms often have reduced expense ratios compared to traditional financial advisors.

- They tend to be a great option for individuals new to investing who want to learn the ropes without complexity.

Exploring Robo-Advisors: A Beginner's Guide to

Robo-advisors have become increasingly trendy in the world of finance, offering a convenient way to manage your investments. For novices, the concept of robo-advisors can seem complex. This short guide aims to demystify the idea of robo-advisors and guide you in understanding how they function.

- , let's define what a robo-advisor is.Essentially, it an digital financial platform that uses software to develop and manage your portfolio.

- {Typically|, robo-advisors require you to provide a profile about your financial goals. Based on your input, the robo-advisor will proactively build a diversified investment strategy tailored to your preferences.

- {Furthermore|, robo-advisors typically incur lower fees compared to traditional experts. This makes them a cost-effective choice for individuals who are looking to grow their wealth without exceeding the bank.

{Ultimately|, choosing a robo-advisor is a personal decision that depends on your particular preferences. By evaluating different choices, you can find the robo-advisor that best accommodates your aspirations.

Master Robo-Advisors: Your Path to Passive Investing

In today's dynamic financial landscape, seeking out efficient ways to expand your wealth has become paramount. Enter robo-advisors, a revolutionary tool that empowers even novice investors to start a journey towards passive investing. These automated platforms leverage sophisticated algorithms and digital models to design personalized portfolios tailored to your specific investment goals.

- Additionally, robo-advisors offer a range of perks such as low fees, round-the-clock portfolio management, and easy account access.

- As a result, if you're aspiring to increase your investments with minimal effort, robo-advisors present an attractive solution.

Investigate the world of robo-advisors and unearth how they can transform your path to passive investing.

Robo-Advisor Essentials: How to Choose and Use Them Effectively

Stepping into the world of investing can feel overwhelming, however robo-advisors offer a simplified approach. These automated platforms manage your investments based on your investment strategy, providing a hands-off experience.

When selecting a robo-advisor, evaluate factors like fees, investment options, and the level of support offered. Furthermore, research online feedback from other users to gain valuable insights.

- In order to effectively use a robo-advisor, clearly define your investment goals.

- Regularly review your portfolio's performance and make tweaks as needed based on changes in your circumstances.

Remember, a robo-advisor is a tool to help you achieve your monetary goals. By making informed decisions, you can leverage its strengths to build a robust financial structure.

Embracing Expansion: A Simple Guide to Investing with Robo-Advisors

Are you ready to begin your investment journey but feel overwhelmed by the complexities? Robo-advisors offer a convenient solution, facilitating you to develop your wealth with minimal effort. These automated platforms utilize algorithms to build personalized investment strategies based on your appetite for risk.

Think about the benefits of digital guidance, where your investments are periodically rebalanced to increase returns. Robo-advisors commonly charge a minimal fee, making them an cost-effective option for people of all capacities.

- Begin investing with a robo-advisor is easy.

- Answer a few questions about your investment objectives.

- Pick a plan that aligns with your appetite for risk.

- Deposit your account and let the automated platform do the rest.

Streamlined Investments

Are you looking for a smarter way to manage their money? Explore the world of robo-advisors, where cutting-edge technology does the heavy lifting. These automated platforms analyze individual financial goals and risk tolerance to craft a personalized portfolio customized just for you. Robo-advisors eliminate the need for frequent market monitoring, allowing you to invest with confidence and achieve their financial aspirations.

- Unlock the power of passive investing.

- Benefit from professional-level portfolio management.

- Remain ahead of the curve with automated rebalancing.

Whether you are just starting your investment journey or looking for to simplify his existing portfolio, robo-advisors offer a efficient and affordable solution. Begin on his path to financial freedom today.

Haley Joel Osment Then & Now!

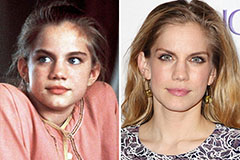

Haley Joel Osment Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!